Anchor Link

This component is usefull for user to see list of content under a page so user can navigate quickly to relevant sections

How to create:

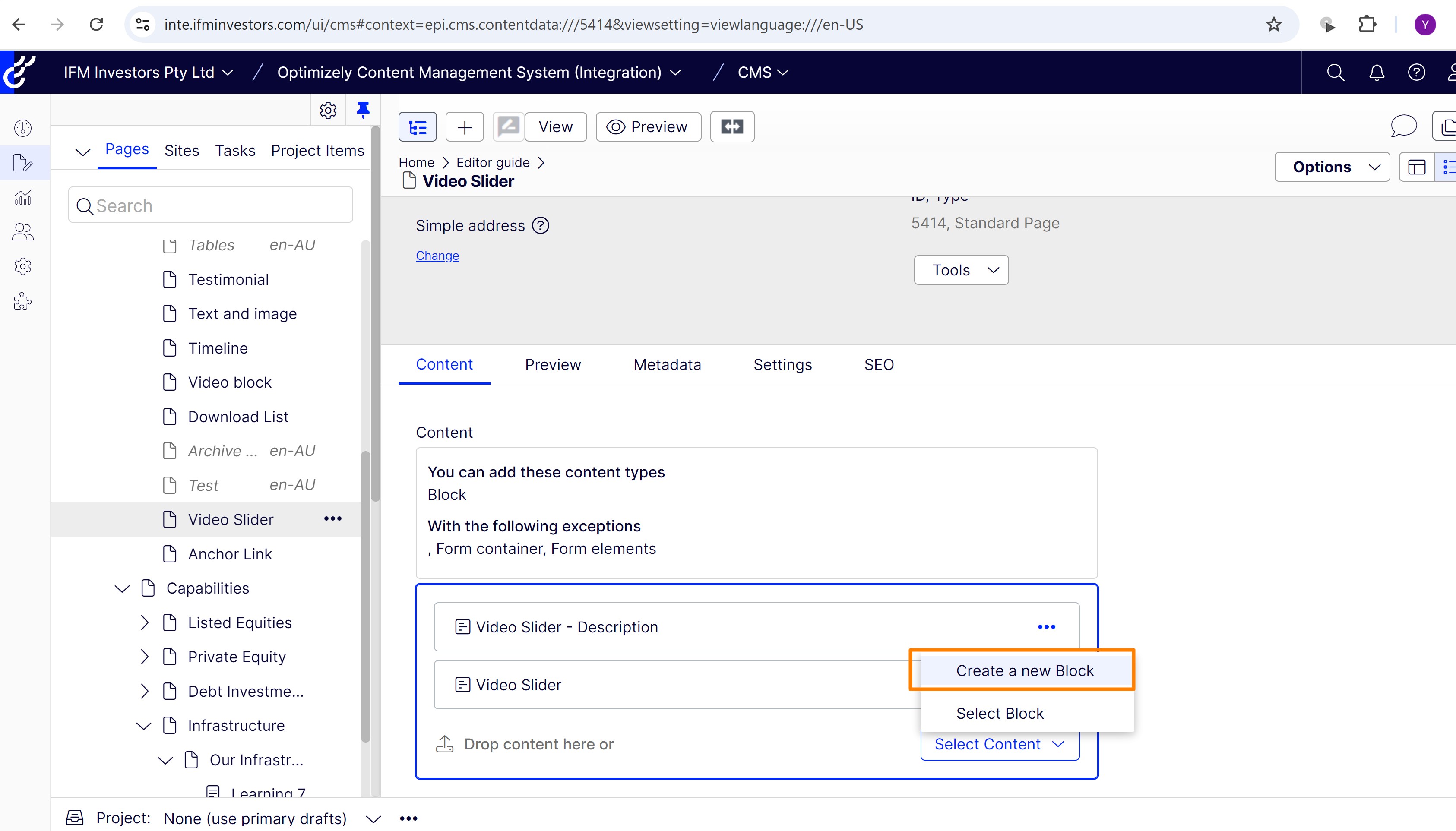

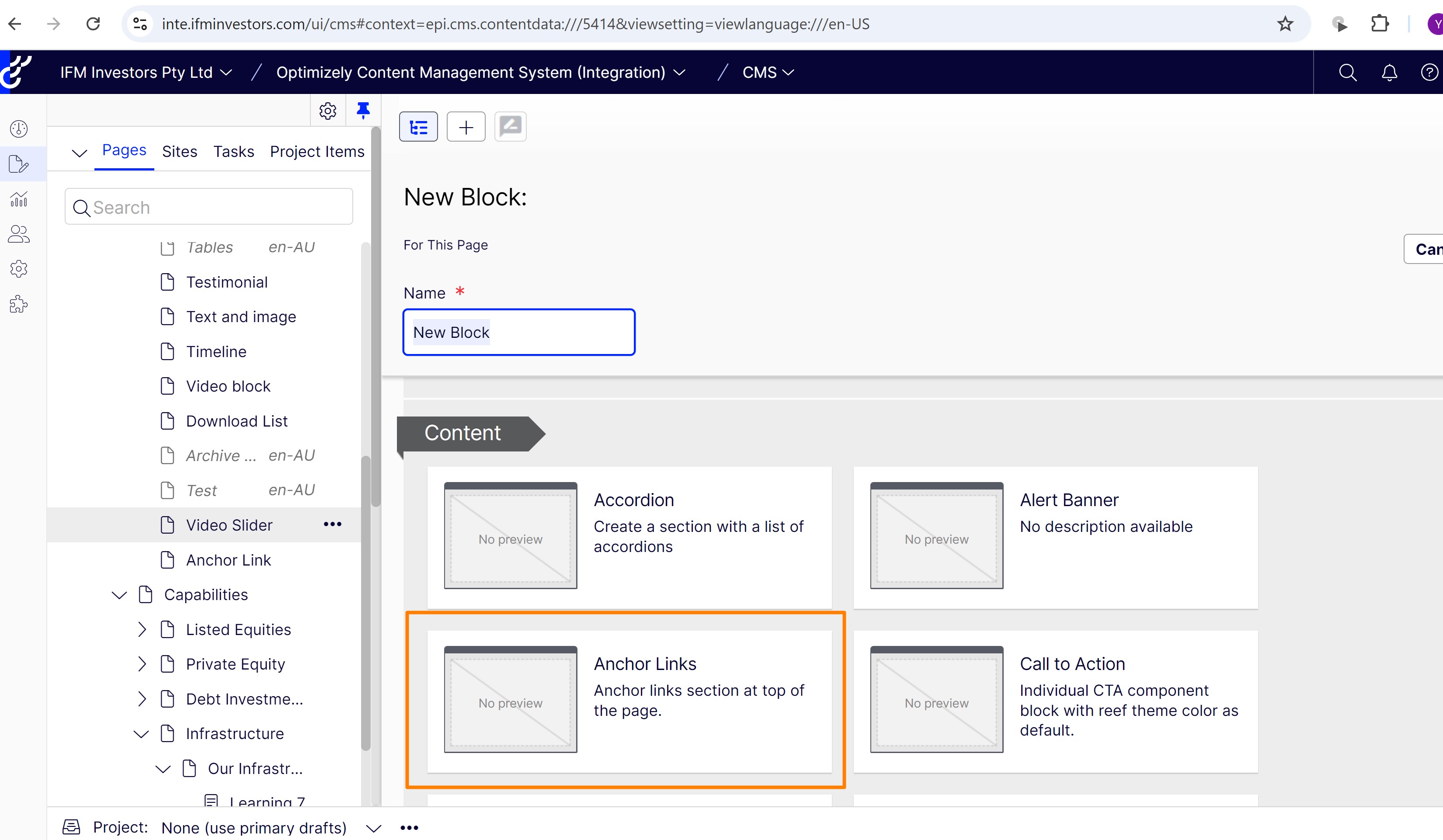

- In the page add the Anchor Link component

- Add more component on the page, and preview it.

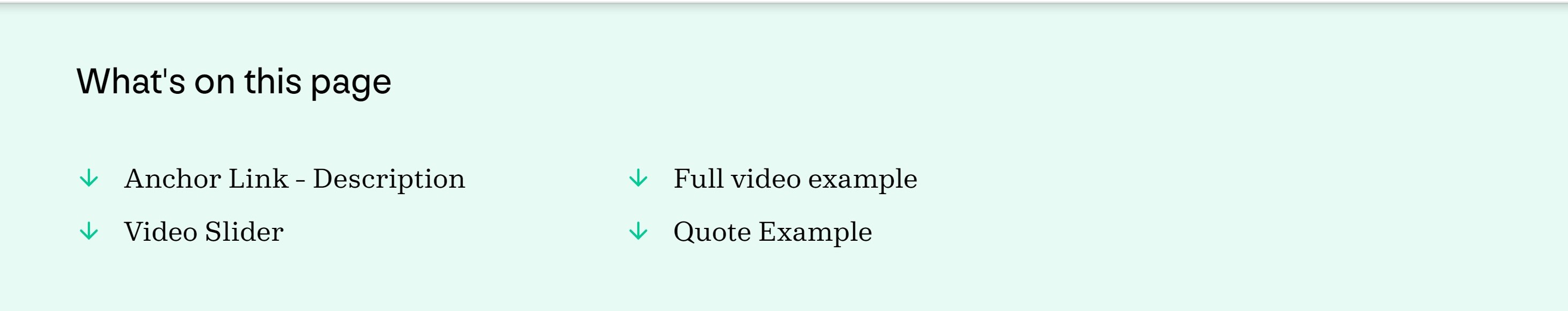

Anchor link will list all the components on the page by following the content order top to bottom. The title will be displayed as anchor to the actual component.

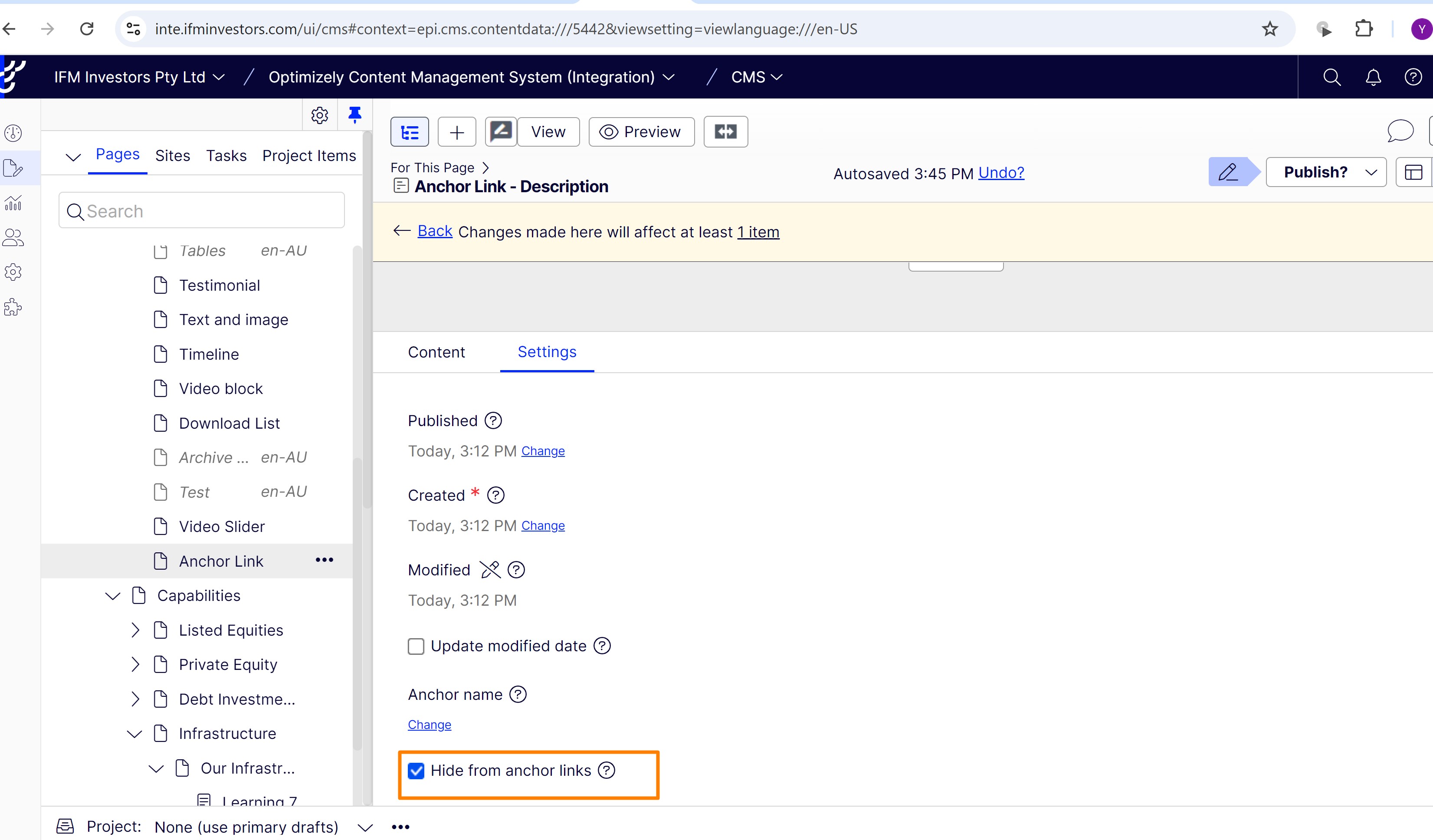

- To exclude a component from anchor link, for example we want to hide the hero banner or description text from anchor link. Go to the related component, for example the rich text > Setting > tick the Hide from anchor links.

Then the component wouldn't be listed on the anchor link.

Infrastructure learnings

Infrastructure learnings

Infrastructure Equity

6 Learnings from 3 decades

IFM Investors has an established track record in infrastructure, built by a long-term approach to value creation. Today, our portfolios invest in assets that include toll roads, airports, seaports, energy, pipelines, renewables, terminals and digital technology, mainly across North America, Europe and Australia. We strive to buy well and manage assets intensively, aiming to deliver resilient returns.

Here are the 6 lessons we’ve learned as an infrastructure equity investor.

Infra Equity - Learning 1 Test

Take a long-term view Test

We think in decades, not in years or quarters.

The essential infrastructure assets we invest in serve communities and underpin the smooth-running of economies over life spans stretching 50 to 70 years, or more.

Infra Equity - Learning 2

Construct an all-weather portfolio

Our long-term, open-ended fund structure enables us to construct an all-weather portfolio – one which supports revenue stability through varying market and economic conditions.

Infra Equity - Learning 3

Build the right team

From our own global team and advisory network to the teams who run the assets, we look to cultivate a team with a diversity of skills and experience.

We recognise the value of specialist industry expertise and we have developed an extensive group of senior advisors to work with us exclusively.

Infra Equity - Learning 4

Buy well

Buying well is the most critical part of the infrastructure investing equation, as it’s very difficult to recover from a bad buying decision. When considering investment opportunities, we look for a series of distinct characteristics.

Infra Equity - Learning 5

Take a conservative approach to leverage

As a long-term investor investing through open-ended funds, we aim for capital structures that are resilient to market cycles. We focus on our assets issuing long-dated, fixed-rate debt while maintaining investment grade credit ratings.

Infra Equity - Learning 6

Create long-term value through active management

Infrastructure is not a set and forget asset class. So actively managing our assets is one of our most important tools for maximising long-term returns to our clients. Our asset management initiatives range from capex programs, financing, M&A, safety reviews, mitigating climate change risk, and cyber security.

Learning 7 - Sub Title

Learning 7

Infrastructure is not a set and forget asset class. So actively managing our assets is one of our most important tools for maximising long-term returns to our clients. Our asset management initiatives range from capex programs, financing, M&A, safety reviews, mitigating climate change risk, and cyber security.

Infra Equity - Learning 1 Test

Take a long-term view Test

We think in decades, not in years or quarters.

The essential infrastructure assets we invest in serve communities and underpin the smooth-running of economies over life spans stretching 50 to 70 years, or more.

Infra Equity - Learning 2

Construct an all-weather portfolio

Our long-term, open-ended fund structure enables us to construct an all-weather portfolio – one which supports revenue stability through varying market and economic conditions.

Infra Equity - Learning 3

Build the right team

From our own global team and advisory network to the teams who run the assets, we look to cultivate a team with a diversity of skills and experience.

We recognise the value of specialist industry expertise and we have developed an extensive group of senior advisors to work with us exclusively.

Infra Equity - Learning 4

Buy well

Buying well is the most critical part of the infrastructure investing equation, as it’s very difficult to recover from a bad buying decision. When considering investment opportunities, we look for a series of distinct characteristics.

Infra Equity - Learning 5

Take a conservative approach to leverage

As a long-term investor investing through open-ended funds, we aim for capital structures that are resilient to market cycles. We focus on our assets issuing long-dated, fixed-rate debt while maintaining investment grade credit ratings.

Infrastructure Equity

6 Learnings from 3 decades

IFM Investors has an established track record in infrastructure, built by a long-term approach to value creation. Today, our portfolios invest in assets that include toll roads, airports, seaports, energy, pipelines, renewables, terminals and digital technology, mainly across North America, Europe and Australia. We strive to buy well and manage assets intensively, aiming to deliver resilient returns.

Here are the 6 lessons we’ve learned as an infrastructure equity investor.

Scroll for more

Our purpose at IFM Investors is to protect and grow the long-term retirement savings of working people.

Through IFM’s unique ownership model, I got the sense that the business truly cared about working people and was not a group of individuals simply looking out for themselves. I saw IFM as a place where I could build a career that I’d be proud of.